Contributed article authored by Joseph Mate, British International Investment

Private Credit Funds – the opportunity for Africa

What is Private Credit?

Generally, the term “Private Credit” is used to describe direct lending by closed-ended funds to mid-sized businesses. However, the term is often applied to a broad spectrum of non-bank lending vehicles – including open-ended trade finance funds, DFI loans, distressed debt funds, infrastructure debt funds, and bilateral institutional lending.

The history of Private Credit

Private Credit Funds date back to the creation of Business Development Companies (“BDC”) by the US Congress in 1980. BDCs invest along the capital structure and allow private mid-market businesses (particularly ones owned by Venture Capital and Private Equity firms) to access private capital from individual investors (FS Investments, 2019).

More recently – Private Credit is associated with the aftermath of the Global Financial Crisis in 2008 which saw a major expansion in the asset class – driven by credit shortages as punitive bank regulation (such as Basel III) caused a retrenchment in mid-market lending; and institutional investors sought higher yields and assets to deploy excess cash (Rede, 2022).

Prior to the recent upward movement in interest rates, the search for yield supported this growth over the past decade – outpacing Private Equity and Venture Capital. The global Private Credit market is estimated to have closed in 2021 at US$1.21 trillion in Assets Under Management (Prequin, 2022).

The impact case for Africa – addressing a market need

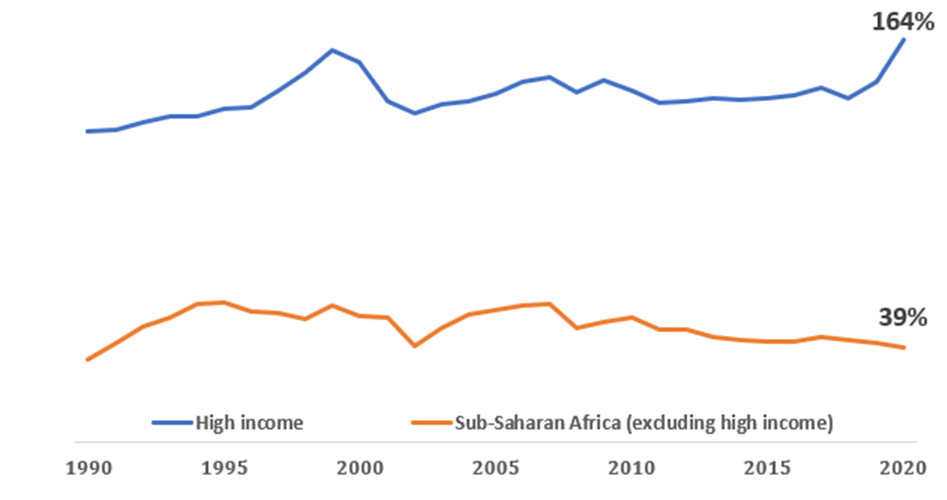

There is a financing gap in Africa for mid-sized businesses which cannot access credit via commercial banks that are retrenching post-COVID, and as regulatory pressures increase. According to the World Bank, credit formation to GDP in Sub-Saharan Africa remains low, especially when compared to high-income countries – see the chart below (World Bank, 2020).

Chart: Private Sector Debt vs. GDP

A more developed Private debt market can help to address this market dislocation, complementing the offering from banks that can be limited by focusing on collateral and not cash flow, with limited scope for tenors beyond three years, and in some markets – with limited access to US$.

The development impact of investing in private credit funds in Africa is two-fold:

Firstly, providing much-needed growth capital to mid-sized businesses will lead to more employment opportunities and goods and services for consumers, as well as a greater contribution to the broader economy through increased taxation. In addition, by undertaking the required financial, ESG, and Business Integrity reporting, these companies may be better positioned to access public markets in the future.

Secondly, capital flow to private credit will have a catalyzing effect by reducing the uncertainty in this asset class and demonstrating that this is an investable strategy with sufficient opportunities that can generate commercial returns.

Private Credit in Africa, therefore, presents a compelling opportunity for investors looking to achieve scaleable impact across the continent.

Real vs. Perceived risk – the case for commercial investors

One of the challenges in attracting institutional capital to Africa is the gap between the real risk of doing business in Africa and the perceived risk. The “Africa narrative” often doesn’t include important themes that make the continent an attractive investment destination. Developments such as a fast-growing, young population, relative political stability in key markets, and the potential for technology to accelerate growth are not factored in when discussing Africa.

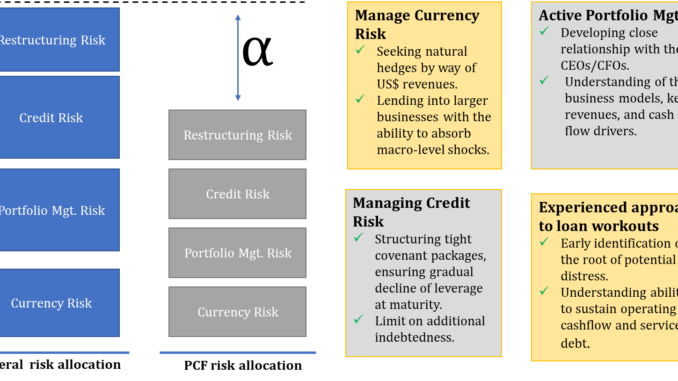

Private Credit can help shift this narrative by unlocking the growth opportunity in the mid-market and supporting the development of the real economy in Africa. In addition, good PCF managers with local relationships and knowledge are able to source businesses with compelling business models and generate superior returns because they are able to allocate risk appropriately, structure loans that reflect the cashflow profile of borrowers and thus facilitate risk-based pricing. The diagram below illustrates this nuanced approach to risk assessment.

Diagram: Mid-Market De-risking

The fundamental features of Private Credit – including downside protection, better visibility on cash flow, and limited reliance on event-driven exits – are well suited for investors with a risk-adjusted approach, looking for diversification and non-correlated returns.

Conclusion

Despite a challenging global macro environment, Africa is well positioned for a rebound post-Covid and economic growth is largely expected to remain resilient in the near term (The World Bank in Africa, 2022). The real economy will be an important driver, especially as the African Continental Free Trade Agreement begins to take effect – boosting intra-continental trade. Africa’s shallow capital markets and low credit formation are significant inhibitors to this growth opportunity. Alternative asset classes such as Private Credit can play a role in addressing this funding gap by channeling much-needed credit to the mid-market – the engine room for growth in Africa. Whilst Development Finance Institutions will be important to build momentum, by supporting an emerging cohort of specialist debt fund managers, the asset class is also compelling for both impact and commercial investors, whose allocations will be critical to achieving scale. Private Credit will therefore play an important role in the African growth story in the coming decades.

References

FS Investments. (2022). FS Investments. Retrieved from FS Investments: https://fsinvestments.com/education/bdc/

Prequin, P. G. (2022). Prequin Global Private Debt Report.

Rede. (2022). Private Credit Report. Private Credit Report.

The World Bank in Africa. (2022, October 27). The World Bank in Africa. Retrieved from The World Bank in Africa: https://www.worldbank.org/en/region/afr/overview

World Bank. (2020). World Bank Data. Retrieved from https://data.worldbank.org/indicator/FS.AST.PRVT.GD.ZS?locations=ZF

This article has been contributed by British International Investment and does not necessarily reflect the views of Africa Capital Digest

Be the first to comment